Vivek Ancillary Profile

Key Indicators

- Authorised Capital ₹ 1.00 M

- Paid Up Capital ₹ 0.32 M

- Company Age 26 Year, 2 Months

- Last Filing with ROC 31 Mar 2024

- Open Charges ₹ 2.00 Cr

- Satisfied Charges ₹ 1.74 Cr

- Revenue Growth 58.27%

- Profit Growth 275.61%

- Ebitda 45.56%

- Net Worth 19.34%

- Total Assets 10.08%

About Vivek Ancillary

Vivek Ancillary Private Limited (VAPL) is a leading Private Limited Indian Non-Government Company incorporated in India on 24 December 1998 and has a history of 26 years and two months. Its registered office is in Faridabad, Haryana, India.

The Company is engaged in the Machinery And Equipment Industry.

The Company's status is Active, and it has filed its Annual Returns and Financial Statements up until 31 March 2024. It's a company limited by shares with an authorized capital of Rs 1.00 M and a paid-up capital of Rs 0.32 M.

The company currently has active open charges totaling ₹2.00 Cr. The company has closed loans amounting to ₹1.74 Cr, as per Ministry of Corporate Affairs (MCA) records.

Gulshan Madan, Anita Madan, Seema Madan, and One other member serve as directors at the Company.

Company Details

- Location

Faridabad, Haryana, India

- Telephone

+91-XXXXXXXXXX

- Email Address

- Website

- Social Media -

Corporate Identity Details

- CIN/LLPIN

U51109HR1998PTC034101

- Company No.

034101

- Company Classification

Private Limited Indian Non-Government Company

- Incorporation Date

24 Dec 1998

- Date of AGM

30 Sep 2024

- Date of Balance Sheet

31 Mar 2024

- Listing Status

Unlisted

- ROC Code

Roc Delhi

Industry

What products or services does Vivek Ancillary Private Limited offer?

Vivek Ancillary Private Limited offers a wide range of products and services, including CNC Machined Components, CNC Turned Components, Bushings, Industrial Bushes, Automotive Wiper Parts, Automobile Fittings & Components, Automotive Shafts, Sheet Metal & Turned Components, Machine Parts, Steel Cutting Services.

Who are the key members and board of directors at Vivek Ancillary?

Board Members (4)

| Name | Designation | Appointment Date | Status |

|---|---|---|---|

| Gulshan Madan | Director | 24-Dec-1998 | Current |

| Anita Madan | Director | 24-Dec-1998 | Current |

| Seema Madan | Director | 24-Dec-1998 | Current |

| Raj Madan | Director | 01-Apr-2007 | Current |

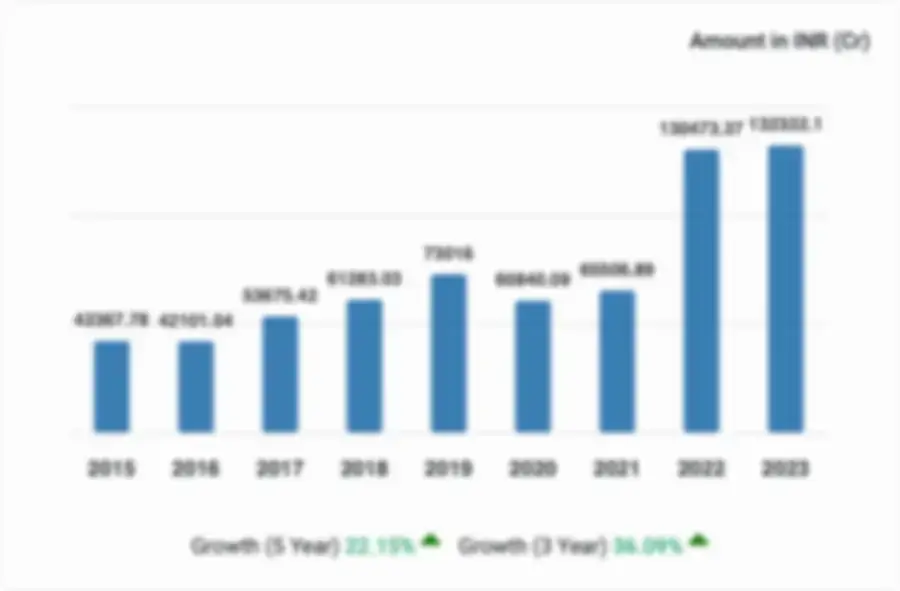

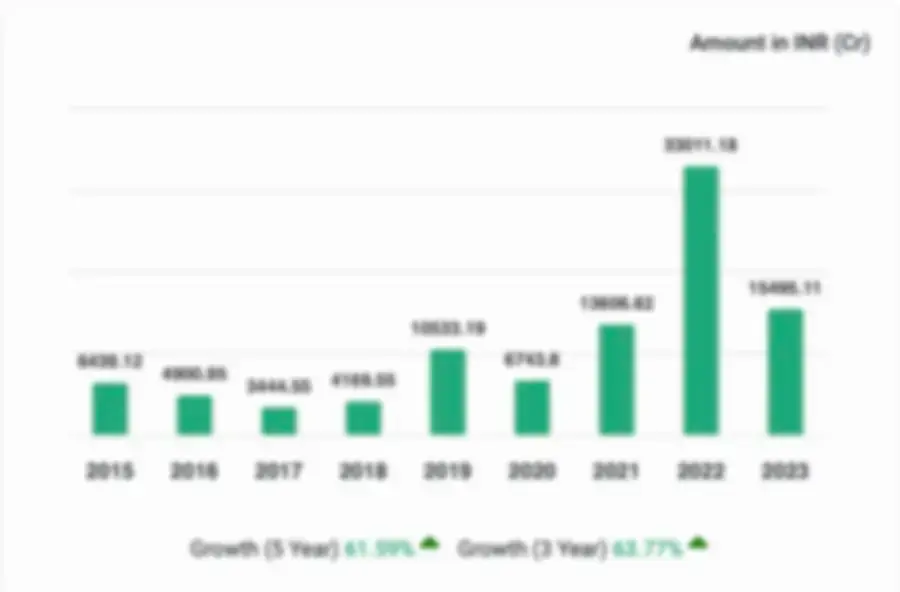

Financial Performance of Vivek Ancillary.

Vivek Ancillary Private Limited, for the financial year ended 2022, experienced significant growth in revenue, with a 58.27% increase. The company also saw a substantial improvement in profitability, with a 275.61% increase in profit. The company's net worth Soared by an impressive increase of 19.34%.

- Key Matrics

- Balance Sheet

- Profit and Loss

- Cash Flow

- Ratios

| Metrics |

| (FY 2022) | (FY 2021) | (FY 2020) | (FY 2019) | ||

|---|---|---|---|---|---|---|---|

| Total Revenue |

| ||||||

| Revenue from Operations |

| ||||||

| Total Assets |

| ||||||

| Profit or Loss |

| ||||||

| Net Worth |

| ||||||

| EBITDA |

|

What is the Ownership and Shareholding Structure of Vivek Ancillary?

In 2022, Vivek Ancillary had a promoter holding of 100.00%. Access key insights, ownership, including shareholding patterns, funding, foreign investors, KMP remuneration, group structure, and overseas investments.

Charges (Loans)

₹20.00 M

₹17.40 M

Charges Breakdown by Lending Institutions

- Others : 2.00 Cr

Latest Charge Details

| Date | Lender | Amount | Status |

|---|---|---|---|

| 20 Mar 2024 | Others | ₹2.00 Cr | Open |

| 17 Sep 2016 | Yes Bank Limited | ₹1.00 Cr | Satisfied |

| 13 Oct 2014 | Small Industries Development Bank Of India | ₹1.40 M | Satisfied |

| 11 Oct 2010 | Icici Bank Limited | ₹6.00 M | Satisfied |

How Many Employees Work at Vivek Ancillary?

Unlock and access historical data on people associated with Vivek Ancillary, such as employment history, contributions to the Employees' Provident Fund Organization (EPFO), and related information.

Deals i

Gain comprehensive insights into the Deals and Valuation data of Vivek Ancillary, offering detailed information on various transactions, including security allotment data. Explore the intricate details of financial agreements, mergers, acquisitions, divestitures, and strategic partnerships that have shaped Vivek Ancillary's trajectory.

Rating

Access the credit rating data, providing valuable insights into the company's creditworthiness and financial stability. Explore assessments from leading credit rating agencies, evaluating factors such as debt obligations, liquidity, profitability, and overall financial health.

Alerts

Stay informed about regulatory alerts and litigation involving and associated companies. Receive timely updates on legal proceedings, regulatory changes, and compliance issues that may impact the company's operations, reputation, and financial performance. Monitor litigation involving subsidiaries, joint ventures, and other affiliated entities to assess potential risks and liabilities.